Manufacturers

Airframe OEM / Component OEM / Engine OEM / Aerostructures / Raw Material Suppliers

NAVEO supports clients in all areas of manufacturing (from the smallest supplier to the largest OEM) to identify growth opportunities, increase efficiency and navigate supply chain headwinds. We keep abreast of trends providing relevant, timely insight in areas such as:

- emerging technologies, including additive manufacturing and advanced materials,

- big data analytics,

- aircraft health monitoring, prognostics and diagnostics,

- cost-reduction initiatives,

- M&A trends and opportunities.

Aftermarket

OEMs (Airframe, Component, Engine OEM)

OEMs want to increase their aftermarket service revenue and to avoid being side-lined by MROs from their airline customers. Rather than just selling piece parts to MROs, OEMs now realise that directly offering operators MRO solutions – such as asset management, health monitoring and analytics, and price-escalation guarantees – can generate lucrative revenue.

OEMs face challenges supporting aircraft in their mature and sunset stages of life. Traditionally, OEM offerings for these stages of an aircraft’s lifecycle have been viewed as expensive and ‘gold plated’. However, OEMs have been responding with new value propositions that leverage tailored workscopes, used serviceable materials and access to leased equipment.

A piece-part sale is a repair opportunity lost. Moreover, those that own the assets control the workscope decisions. OEMs can protect against PMA parts and margin leakage through compelling aftermarket service offerings. Avoiding the temptation to discount rotables in end of quarter fire-sales, also helps stem the margin leakage to surplus parts and better maintains pricing discipline.

They are also investing heavily in, and well positioned to exploit, big data analytics. Engine OEMs have been monitoring engines since the 1990s, but airframe and system OEMs are now focused on the latest generation aircraft. Those OEMs that can demonstrate value, enhanced reliability and responsiveness to airlines will be rewarded and create stickiness and close customer relationships.

MRO Integrators (multi-product MRO providers)

Integrator MROs, such as Lufthansa Technik, AAR, SR Technics, ST Aerospace, and Air France KLM E&M, face competitive headwinds from OEM focus on the aftermarket. In-sourcing and capability expansion at airlines, such as Etihad, Delta and Emirates, also provide further competition.

The component asset management market is increasingly commoditised and it’s difficult to differentiate when price is a determining factor. MROs need to reduce costs and leverage data analytics either through developing their own in-house system or partnering to increase reliability and programme profitability.

Integrators must learn how best to work with the OEMs, while also competing with them. They need to access intellectual property, proprietary repairs, parts and technical support at a time when OEMs are being selective as to which companies they closely partner with.

Airframe OEM broad component maintenance offering sales success have cut off the integrator from some airlines and caused price competition as all players seek to gain market share.

Independent MROs & Part Repair Providers

Independent MROs have seen a lot of M&A activity recently, as companies focus their activities on either working with OEMs and integrators, or growing capabilities to compete vigorously with them.

Their challenge is how to maintain their position in the face of the OEM’s greater pricing power, material supply and data analytics capability. Some ways to do so include differentiating (e.g. in engine part repair) and providing services to support OEMs, as well as leveraging surplus parts (including piece-part reclamation), DER repairs and cost-focused workshops.

Surplus Parts Traders & Asset Managers

Both airlines and OEMs are increasingly accepting used serviceable material (USM). They are incorporating it into their procurement techniques and into repairs of engines and systems respectively, as it is both cost-effective and a good way of alleviating long lead times for new parts.

OEMs are also looking to better understand the margin leakage from and revenue opportunity of USM, so are partnering with USM providers or establishing in-house trading capability to do so.

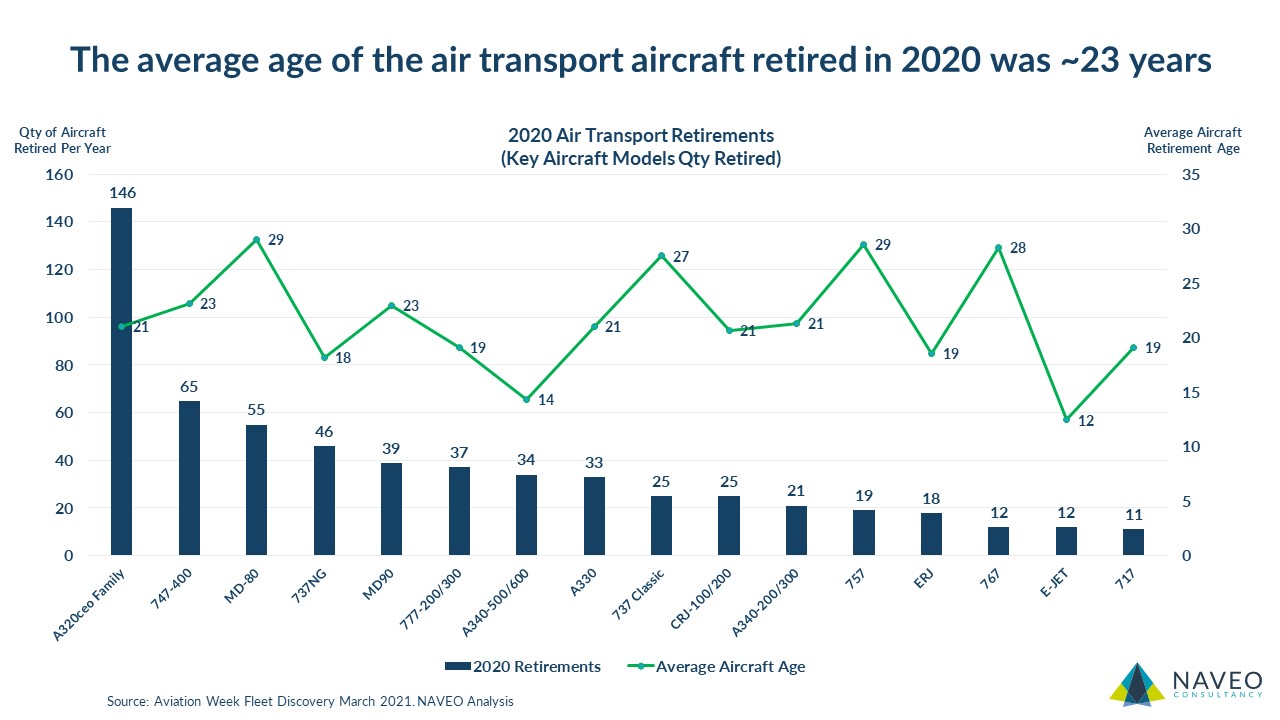

Over the next few years, increasing retirements of mature aircraft, such as 777s, A330s, 737NGs and A320s, will mean OEMs face greater competition from USM for provisioning and AOG sales. But, as supply of USM increases, it will provide cost-effective opportunities to airlines to substitute for repairs and leverage used material.

Some surplus part traders have started to include MRO capability for components, composites and engines. They want to offer a broader range of services to their airline and MRO customers than simply transactional used part sales.

Parts Manufacturer Approval (PMA) Providers

A combination of production ramp-ups and in-service reliability issues has caused new material supply to be challenged. It’s suggested that PMA providers, including those who are OEM-licensed, could help MROs and OEMs address part shortages. That’s worth exploring if they also have engineering talent OEMs could tap into.

Poor performance by OEMs on part delivery has been a key driver for non-OEM part development, instead of the perception that it is simply about cost. Many non-OEM parts have been developed as an alternative to long OEM lead times.

However, many operators still don’t accept PMA parts in safety critical areas. Furthermore, many lessors take a view that PMA reduces the liquidity of their assets and so typically expect OEM configuration from their customers.

Consequently, PMA suppliers have seen M&A activity and have grown their MRO capability and expanded into distribution thereby diversifying their revenue beyond traditional PMA parts.

Training Providers

The shortage of pilots, engineers and mechanics is well known. Dedicated training schools, OEM and MRO in-house training programmes are trying to address this issue. Training providers are exploring opportunities in growth regions with airlines and MROs seeking a supply of well-trained staff fluent in the latest technologies and production and maintenance techniques.

Investors

NAVEO assists investors seeking opportunities in aerospace production and/or aftermarket. It helps identify companies with differentiated technologies, intellectual property, leading value propositions and market positions that offer attractive investment prospects.

Whether it is in the identification of targets or buy- or sell-side due-diligence support, NAVEO can provide an independent assessment, including analysis on the target’s position, operating market, revenue outlook, management competence, competitive landscape, strengths and weaknesses, and potential growth and bolt-on opportunities. We can assess a target’s operational performance with customers and suppliers.

Industry Insights

More News

Date: March 29 , 2022 |

Air Transport Aircraft Retirements Update |

The air transport aircraft retirement tsunami that was expected has, so far, failed to materialize. 2021 saw the lowest official retirements since 2007, with only ~429 aircraft being recognized as being officially ret... |

READ MORE  |

Date: November 23 , 2021 |

Tracking the Air Transport Utilization Recovery |

April 2020 marked the low point in air transport fleet utilization. Since then, aircraft flying hours have been steadily increasing. However, the speed of the recovery has varied by size of aircraft (e.g., narrowbod... |

READ MORE  |

Date: March 12 , 2021 |

Reviewing 2020 Aircraft Retirements |

So, how many air transport aircraft retired in 2020? Thousands? Nope. 2020 did not yield the thousands of retirements that had been feared. Though the final tally will be subject to revision in the coming months, so f... |

READ MORE  |